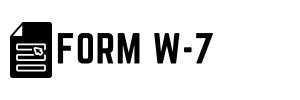

IRS Form W-7 with Instructions for 2023

The IRS W-7 Form Instructions for New Applicants in 2023

In this article, we're about to examine an important document in the USA - the IRS W7 application - issued to apply for an Individual Taxpayer Identification Number (ITIN). People who are not qualified for Social Security Numbers (SSN) but still need to file a federal tax return use this form.

Moving on to the help given by form-w7-instructions.com, it reduces the hassle in this process. Our website offers a precise guide with Form W-7 and ITIN instructions. The material on the platform includes simplified instructions and clear examples. This is highly beneficial for those who must fill out the W7 form on their own. Each step to complete the application is explained in simple language, making it easier to avoid mistakes. The examples given help in understanding every aspect of the sample practically. Using this website, the task of filling out the document becomes less complex and time-consuming.

W-7 ITIN Application Form: Eligible Applicants

Let's figure out who must deal with the IRS ITIN application. According to the W-7 application instructions, it's required if you are not eligible for a Social Security Number but need an Individual Taxpayer Identification Number. This may include nonresident aliens, resident aliens, or dependents/spouses of U.S. citizens or resident aliens.

The W-7 Form Example of Use

Let's suppose there's a lady named Linda. Linda hails from the UK and lives in the United States as a resident alien. However, Linda needs to pay her taxes. This is when the IRS Form W7 in PDF comes into play. She fills out the template to secure her ITIN, which aids in fulfilling her tax responsibilities in the United States. Linda can access ITIN W7 instructions to simplify the process. These streamlined steps make it convenient for Linda to file the necessary taxes without any struggle. Despite her non-American origin, she acknowledges her fiscal obligations in a foreign land with the right resources and comprehensive guidance.

Guide to Fill Out the W7 Form

Filling out an IRS Form W-7 can seem tough, but with clear instructions, it can be simple. This guide will help you complete the W-7 form correctly and with ease, ensuring you avoid common mistakes.

Each box corresponds to unique information; avoid confusion by re-reading the IRS Form W-7 instructions. Attach the necessary documents, sign and date your copy before you submit it. A smooth process is possible with proper understanding and attention to detail.

When File the W-7 Form

The deadline to fill out and file the application is not mentioned in the IRS W7 form instructions for 2023. However, it is advisable to apply for an ITIN as soon as possible if you are required to have one for tax purposes. The IRS recommends that you apply for an ITIN when you file your tax return.

Printable W-7 Form and Common Mistakes

Applying for an IRS Individual Taxpayer Identification Number can take time and effort. Some common slip-ups occur while filling out Form W-7.

- Wrong filing status

Check IRS W7 instructions to select the proper filing status. - Misspelled name

Be cautious to fill in your name as it seems in your legal document. - Incorrect birth date

Always ensure to double-check your birth date. - Forgetting signature

Make sure to sign and date the application.

To avoid these errors, carefully read the IRS W-7 instructions in PDF before you start. It guides each step of the form. Keep your documents handy and double-check each entry before submitting. Mistakes can delay the process, so take your time to do it correctly. With careful attention, you can fill out your W-7 form immediately.

The IRS W7 Application: Popular Questions

More about the W-7 Tax Form

Please Note

This website (form-w7-instructions.com) is an independent platform dedicated to providing information and resources specifically about the W-7 form, and it is not associated with the official creators, developers, or representatives of the form or its related services.