IRS Form W-7: ITIN Application

The Internal Revenue Service (IRS) uses Form W-7 to grant an Individual Taxpayer Identification Number (ITIN) to those who require it. This IRS W-7 ITIN application is essential for those who have tax duties but do not meet the criteria to receive a Social Security number.

Understanding the W7 Application in PDF

You can easily download the IRS W-7 application form in PDF format from the official IRS website. This simplified digital option helps streamline the application process. The form consists of different sections, each seeking specific information like your personal details, foreign tax ID data, and reasons for applying. It is important to fill out the W7 ITIN application accurately and honestly to prevent any mistakes or delays in the process.

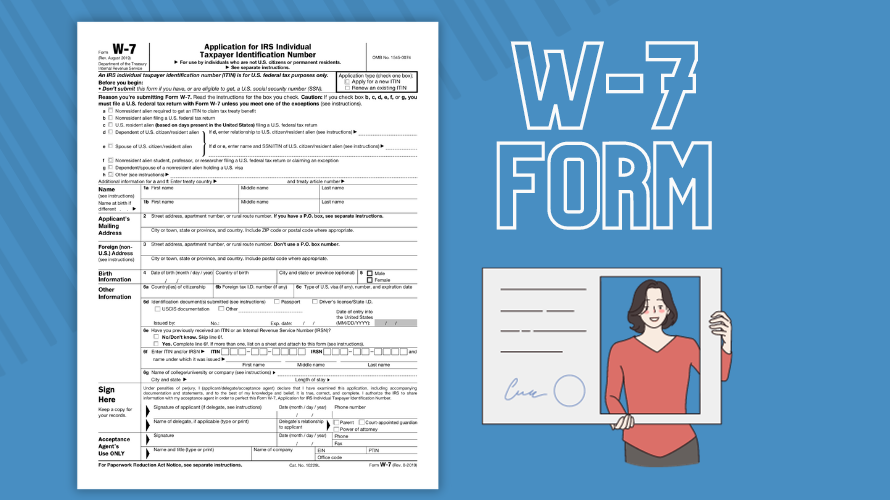

ITIN Form W-7: Applying Rules

Ranging from non-resident aliens who have a federal tax obligation to resident aliens (in certain cases) to spouses or dependents of U.S. citizens or resident aliens, various categories of individuals can make use of the IRS W-7 application form. It must be noted the IRS scrupulously reviews each application. Hence, ensuring accurate details is vital.

Individuals who meet the criteria to obtain a Social Security number should not make use of the Form W-7 for an ITIN. In addition, if an individual already possesses an ITIN or a Social Security number, there is no necessity to reapply using the same form, as ITINs do not expire.

Common Pitfalls in the W-7 ITIN Application

Filling out an IRS Form W-7: ITIN application for the first time can be daunting, and sometimes, mistakes happen. Here are some common problems applicants face when filling out the W7 ITIN application.

- Not understanding the application.

- Misprint or misinformation on the template.

- Failure to send the document to the correct address.

Solving Common Problems

To avoid any complications, follow these simple solutions:

- Take some time to understand the form and instructions provided on it. Reach out to professional aid if needed.

- Ensure you have filled all the columns accurately and double-check your information.

- Double-check the address provided on the IRS website or form instructions before sending off your application.

Filing the IRS Form W-7 and obtaining an ITIN is not as difficult as it sounds if you understand what is required in the form and follow the instructions properly. Be thorough, and take your time to check and recheck before submitting. With patience and care, you'll have your ITIN in no time.

Latest News